Tax return

Your tax return by a professional. Bern, Fribourg, Geneva, Neuchâtel, Valais, Vaud whatever your canton of residence, we are there for you.

Canton of residence

Bern, Fribourg, Geneva, Neuchâtel, Valais, Vaud

Have your tax return completed by a professional

Bern, Fribourg, Geneva, Neuchâtel, Valais, VaudNo matter your canton of residence, we are there for you.

The annexes to complete a tax return are often a headache. We have prepared the list below (PDF) to help you figure out what documents are necessary. Once have everything, send us your files either in person or by email and we will do the rest.

Don't forget to tell us your place of work and your activity rate for each of your jobs. You can simply note them on the salary certificates or send them to us in your email.

Please note: if you provide us with the documents in paper format, please do not staple the documents.

Note for home-owners:

Maintenance costs are deductible. These include in particular:

- Fire insurance premium (ECA, ECAB)

- Building insurance premium

- Municipal taxes for purification and waste disposal

- Renovation costs (replacement of existing elements, for example a washing machine which has broken down)

- Garden maintenance costs

Online tax declaration

Save yourself a trip and send us your documents online so we can complete your tax return. Simple, fast and secure.

1. Download the list

Download the list of documents. Make sure you have all scanned documents in PDF format.

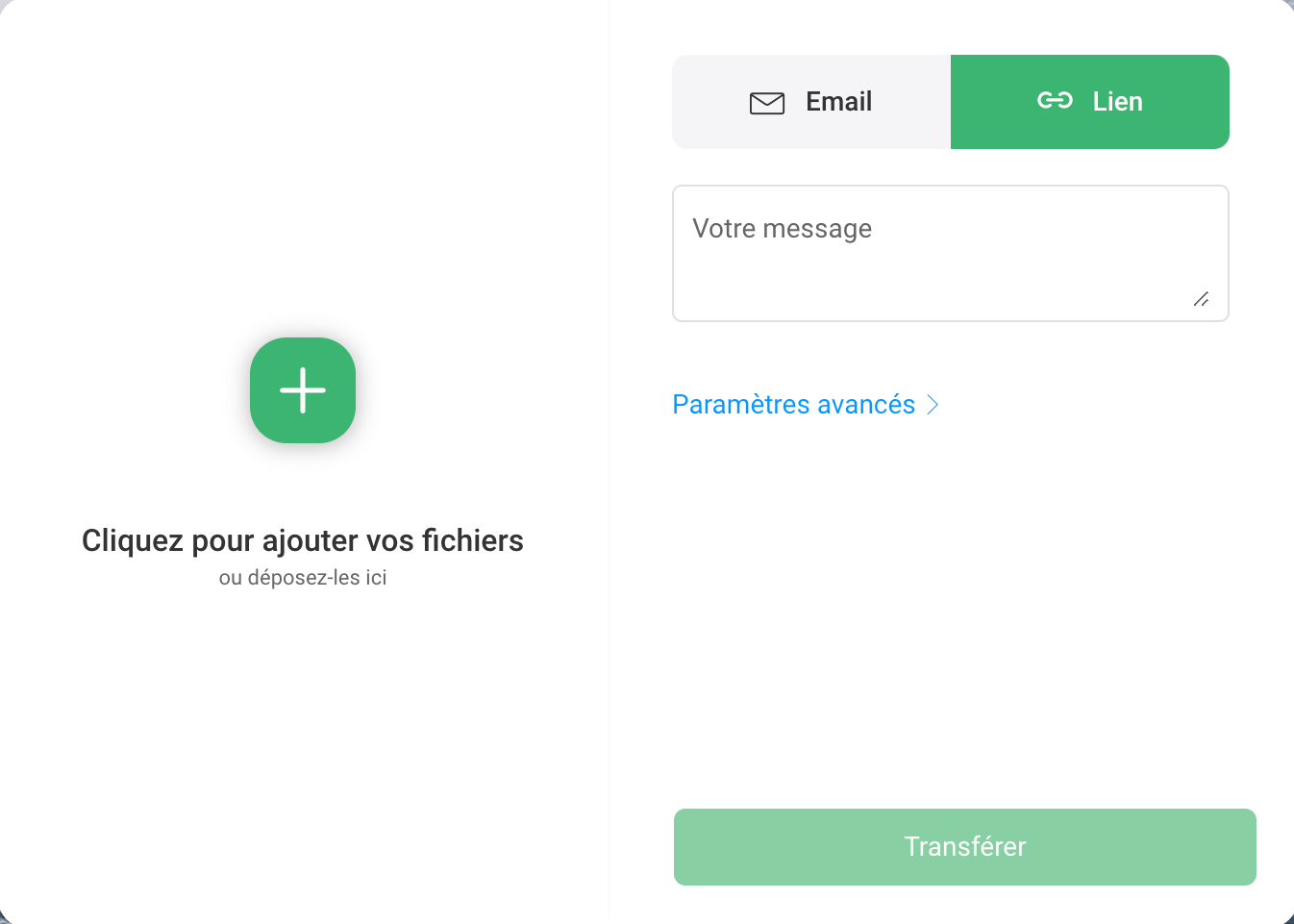

3. Choose the “Link” option (1) then click “Transfer” (2).

Your files will be sent via SwissTransfer. Once the transfer is complete, a link will appear that you can copy. If you click on the button, the copy is done automatically (3).

2. Import your files

Go to the secure SwissTransfer.com site and import your PDF files. If you want, you can bundle them into a .zip file, but it's not necessary.

4. Fill out the form with the link

Then fill out the form below and paste the link into the message. We will confirm receipt by email and will do what is necessary.